Tag Archive for: Women

Many Americans Face a Bitter-Sweet Early Retirement. What Should They Do?

He was sitting on a bus stop bench outside a tranquil park, wearing a khaki suit, checkered blue shirt and sneakers. A plain white box rested on his lap when he greeted a stranger and offered her a chocolate saying, “My Mama always…

5 Important Actions To Take During Financial Literacy Month

Happy Financial Literacy Month! Financial literacy is the ability to understand your comprehensive financial situation and make effective, optimal decisions using all the financial resources you have available. Financial literacy is a lifelong…

How Women Business Owners Can Save For Retirement And Reduce Taxes

Women are expected to live another 21 years after retiring at age 65––three years longer than their male counterparts. Despite this fact, women are shockingly ill-prepared for retirement, having fewer investments and less money saved on…

PRESS RELEASE: Steve Booren Recognized in Forbes as a 2021 Best-in-State Wealth Advisor

DENVER, Colo. — February 11, 2021 – Steve Booren of Prosperion Financial Advisors was recently ranked No. 34 in Colorado in the 2021 Best-In-State Wealth Advisors list published by Forbes.

According to Forbes, the annual list spotlights…

What I Do & How I Help

Planning is a part of life. We plan our days, our years, our vacations, our careers…the list goes on. It’s easy to get so caught up in the day-to-day planning and focus only on what’s in front of us that we forget to do the most important…

It’s A New Year! Is It Time To Reevaluate Your Financial Plan?

A new year is often a time for fresh starts, intentional planning, and renewed motivation to conquer goals and accomplish things that are important to you. And after the year we just had, a fresh start is just what we need. As you transition…

Improving Investor Behavior – Hindsight in 2020

They say hindsight is 20/20, and as we make the year 2020 hindsight, it's a good time to reflect. What did we learn? What surprised us? How can we use our past to make our future bigger and better?

It was former Secretary of Defense Donald…

Why Do People Really Buy Gold And What Are The Alternatives?

Warren Buffet once said, “Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again, and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching…

Your 7-Point Checklist For When Life Suddenly Changes

Let me start with a story. I live in Denver, Colorado, with my husband, Brian, and our two beautiful daughters, Addie and Eden. One perfect day in Breckinridge, Colorado, we were doing what we love to do as a family—snow skiing at our favorite…

Your Comprehensive Financial Planning Guide For Women

Over half of the wealth in the U.S. is controlled by women.[1] You are probably reading this because you are one of those women. Finances can be intimidating, so I have dedicated my career to helping women like you gain the confidence to take…

Highlights of the CARES Act

Late last week the senate passed and the President signed the CARES stimulus package designed to, among many things, curb the financial turmoil created in the wake of the Coronavirus. This $2.2 trillion, 800+ page legislation offers meaningful…

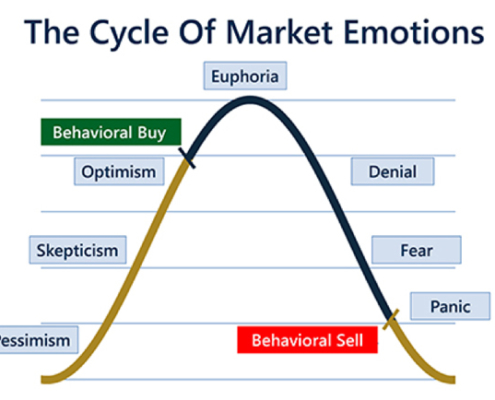

Timeless Truths & The Cycle of Market Emotions

Just 30 days ago, on Feb. 18th, markets were at all-time highs. Today, fear grips the market and recession is at the top of every financial pundits’ mind. Benjamin Graham, said to be one of the best investors of all time, and a mentor to Warren Buffett reminds us: Control what you can control: yourself, your emotions and your response (or behavior) to those emotions.

Improving Investor Behavior – Investing in Panic

A lot can change in 30 days. One short month ago, markets were knocking on the door of all-time highs, businesses were doing well, and Joe Biden was behind several candidates in the Democratic primaries.

Oh, how things change quickly. Very…

A Note to Clients on Virus Volatility

As I’m sure many of you are aware, this past week has been a difficult one for investors. The broad market indices have seen swift and dramatic drops, leaving many scared, confused, and upset.

Make no mistake; it is moments like these that define all of us as investors. Fear is an emotion, and one that can quickly snowball into an all-out panic. We’ve often said your behavior as an investor will ultimately have a far greater effect on your outcome than when or how you are invested. This is one such moment.

PRESS RELEASE: Steve Booren Recognized in Forbes as a 2020 Top Wealth Advisor in Colorado

DENVER, Colo. — January 30, 2020 – Steve Booren of Prosperion Financial Advisors was recently ranked No. 26 in Colorado in the 2020 Best-In-State Wealth Advisors list published by Forbes.

According to Forbes, the annual list spotlights…