History Over Headlines

Perspective is in increasingly short supply right now. Business news and market commentary is ever focused on urgency. But good investor behavior requires thinking long-term, staying grounded, and resisting the belief that daily market machinations are important enough to warrant changes.

Meeting Mr. Market

What would it look like to have a conversation with “The Market” (the embodiment of the S&P 500)? What knowledge might we learn from this nebulous thing if only we could ask it? Let's find out.

Safety in Numbers

As of December 31, the “Magnificent Seven” accounted for roughly half of the Index’s 2024 gain, according to CNBC. This has left many people wondering, are these companies deserving of this much capital, or is a bubble inflating America’s largest enterprises?

We Planned for This

With the holidays rapidly approaching, I find late December is a great time for family, friends, festivities, and a little reflection. The end of 2024 marks an important milestone: The first quarter of this century is now behind us. If you’re…

Keep Politics Out of Your Investment Strategy

In just over two weeks, Americans will head back to the polls to decide, among other things, who will lead our country for the next four years. Rest assured this won’t be a political article attempting to sway you toward any candidate. Instead, I want to share a story about a former client who, ahead of 2020 election, decided to sell his investments to avoid election uncertainty.

Volatility: Seen and Unseen

A few weeks back, a colleague showed me an article on commercial real estate in the Denver Tech Center. Apparently a few well-regarded buildings had changed hands at prices that caught his eye. The surprising news was the sell price earlier this year...

Market Forecasting: A Loser’s Game

It’s Friday, August 2, and I’m writing this article with CNBC open on my browser. The headline shouts, “Dow Loses 750 Points, Nasdaq Enters Correction After Weak Jobs Report.”

Compounding Quietly

Compounding growth, whether in nature or finance, is similar: enough time can bring impressive results. Seemingly every few years, a familiar story is published. A quiet person from a forgotten town, typically with little or no education and a low paying job, accomplishes the unusual.

Selling Fear, Greed, or Both

Across social media and YouTube, there are no shortage of pundits, professional or otherwise, offering financial “advice.” I congratulate writers focused on educating readers about these concepts. But my sense is many of these “gurus’” acquire and grow their income not on the education they offer, but on the number of eyeballs they attract.

Planning for Lasting Inflation

If you’ve been to a grocery store lately, the announcement from the Federal Reserve last week should not have been surprising: inflation seems to be sticky. While some progress has been made in reducing the inflation rate, prices remain elevated…

The Value of a Sale

Did you partake in any Black Friday sales last year? The annual shopping event following Thanksgiving, named black Friday for its ability to get retailers “back into the black,” had retailers concerned in 2023. With prices rising everywhere…

Is Your Home an Investment?

The former home of Groucho Marx, the cigar-chomping, round-glass wearing comedian of the 1920s, is up for sale in Long Island, New York. For the low price of just $2.3 million, you too could own the five-bedroom, 3,800-square-foot home built…

45 Years, 25 Lessons

A few weeks ago I attended the retirement party of someone I’ve called a dear friend for over 49 years. Long ago, we were both young financial advisors chasing similar career paths. We even migrated to independent businesses around the same…

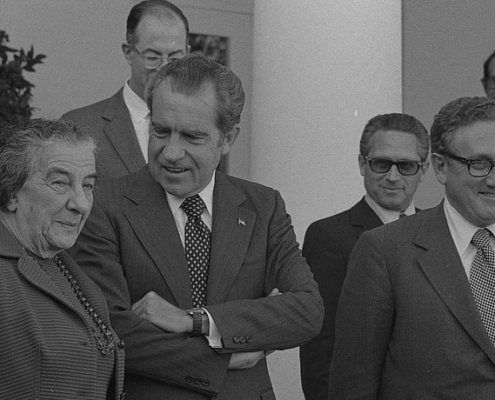

Where Were You 50 Years Ago?

October 2023 marks the 50th anniversary of one of the most tumultuous months in American history. Do you recall the events of October 1973?

October 6, 1973 – On Yom Kippur, the most sacred day in the Jewish calendar, Arab states led…

The Pro’s and Con’s of Passive Investing and When To Engage a Financial Advisor

Passive investing, an investment strategy aimed at maximizing returns over the long run by keeping the amount of buying and selling to a minimum, is a popular choice for many. However, like any financial strategy, it has its pros and cons. To…