Tag Archive for: Millenials & Young Professionals

Improving Investor Behavior – Hindsight in 2020

They say hindsight is 20/20, and as we make the year 2020 hindsight, it's a good time to reflect. What did we learn? What surprised us? How can we use our past to make our future bigger and better?

It was former Secretary of Defense Donald…

What Are You Doing on November 4th?

Election Day, Tuesday November 3rd, is only a week away. While 2020 has been historic, it seems that everyone has a dramatic expectation of what will happen in the investment markets, as if it will be the "next" big 2020 disruption.

This morning…

Improving Investor Behavior: Keep Politics Out of Your Portfolio

With the election a short 45 days away, the news stream is unrelenting. Political TV ads, postcards, and of course those phone calls during the dinner hour - it’s an all-out media assault designed to convince you that if the “other guy”…

Improving Investor Behavior: Blind Spots & Confirmation Bias

We talk a lot about perspective in this article. Our perspective is the lens through which we view the world. It is our way of framing everything we see and ultimately defines how we react to what life throws at us. We believe what we believe…

Getting Back to Better

My goal as a parent has always been to build a better future for my kids, and to give them opportunities that I didn’t have. Whether that’s financial, educational, personal, or whatever it may be. It’s an essential part of my “why.” I think deep down there’s a part of us that wants our kids to be better than we ever were. To me, that’s progress and hope. It’s an innate and immeasurable desire - to want our tomorrow to be better than our today.

Improving Investor Behavior: An Unintentional Sabbatical

Has it been a month already? In some ways, this feels like the longest 30 days many have ever experienced. For others, it seems to have gone by way too quickly. When much of the world is committed to staying home and avoiding COVID-19, time…

Fire Drills and Why We Do Them

Every meeting we have with clients includes a line item on the agenda: Fire Drill.

What would you do if the market dropped significantly tomorrow? What would that look like for you? For years now it has felt like an unnecessary discussion…

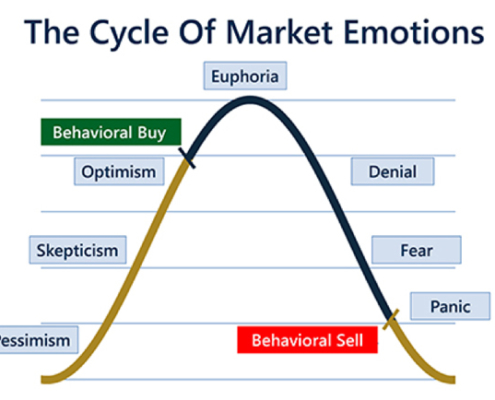

Timeless Truths & The Cycle of Market Emotions

Just 30 days ago, on Feb. 18th, markets were at all-time highs. Today, fear grips the market and recession is at the top of every financial pundits’ mind. Benjamin Graham, said to be one of the best investors of all time, and a mentor to Warren Buffett reminds us: Control what you can control: yourself, your emotions and your response (or behavior) to those emotions.

Improving Investor Behavior – Investing in Panic

A lot can change in 30 days. One short month ago, markets were knocking on the door of all-time highs, businesses were doing well, and Joe Biden was behind several candidates in the Democratic primaries.

Oh, how things change quickly. Very…

A Note to Clients on Virus Volatility

As I’m sure many of you are aware, this past week has been a difficult one for investors. The broad market indices have seen swift and dramatic drops, leaving many scared, confused, and upset.

Make no mistake; it is moments like these that define all of us as investors. Fear is an emotion, and one that can quickly snowball into an all-out panic. We’ve often said your behavior as an investor will ultimately have a far greater effect on your outcome than when or how you are invested. This is one such moment.

Improving Investor Behavior – Campbell’s Soup & Rising Income

Cold winter weather means it is soup season here in Colorado, and none feel more familiar than Campbell’s Tomato Soup. Campbell’s tomato soup is an excellent benchmark for understanding the impact of the persistent enemy of all investors: inflation. For more than 100 years, the size hasn’t changed, but the price sure has. About 45 years ago, in 1974, the soup cost about $0.12 per can. Today, it retails for about $0.87 per can. That points to an average inflation rate of 4.3 percent. Forty-five years may sound like a long time, but that’s about the length of a typical retirement.

PRESS RELEASE: Steve Booren Recognized in Forbes as a 2020 Top Wealth Advisor in Colorado

DENVER, Colo. — January 30, 2020 – Steve Booren of Prosperion Financial Advisors was recently ranked No. 26 in Colorado in the 2020 Best-In-State Wealth Advisors list published by Forbes.

According to Forbes, the annual list spotlights…

The Decade in Review

As financial advisors we’re constantly advocating for investors to maintain a long-term view. We consider it to be fundamental, not only as an example of good investor behavior, but as a way of minimizing the emotional toll of “riding the rollercoaster”.

But what does it mean to have a long-term perspective? How long is long enough?

Improving Investor Behavior – The World’s Worst Market Timer

Do you ever feel “the curse” of investing at precisely the wrong point? Like you invested too late, at the wrong time, or maybe you’re just unlucky? Let me introduce you to Bob – the World’s Worst Market Timer.

Improving Investor Behavior: Investing time now will pay dividends later

The average American spends more than 85 hours per month watching TV. The same person will likely spend about 265 hours sleeping and 228 hours working. Know how much time they’ll spend working on their finances? About 1.8 minutes, (yes, that works out to 96 seconds) per day.