A Necessary Bucket of Cold Water

The markets have been off to a turbulent start for 2022. With the S&P 500 down about 15 percent since its peaks in January, this year marks one of the worst starts for investors since 1970. Any number of reasons may seemingly justify the…

Improving Investor Behavior: The Peloton and Tiramisu

If you're like me, you exercise a lot. Maybe not every day, but you try to hit the gym most days. You sweat, you grunt, you grind it out, every session. Exercise does two things: it makes you hungry, and it gives you a sense of pride or accomplishment.…

The Flaw of Average Inflation

The flaw of averages is the idea that plans made based on average assumptions are wrong on average. As an example, think about the statistician that drowned while crossing a river that was, on average, three feet deep.

Understanding Your Stock Compensation Sure is “Something”

Have you ever ignored doing something you knew that you should do? What “something” immediately came to mind when I asked that question?

Its OK. We all do it. Maybe that something you're ignoring is uncomfortable to face, maybe it's boring,…

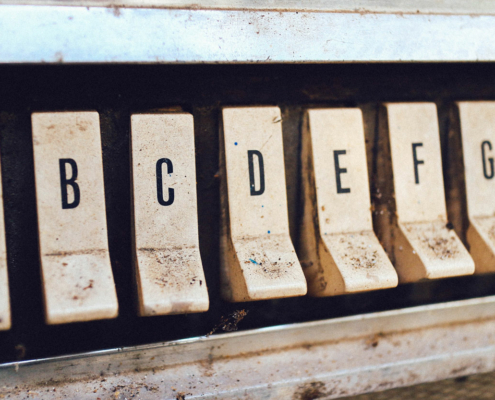

ABC (and D)’s of Equity Compensation

Congratulations! If you’re reading this article you’ve likely been offered some form of equity compensation. Perhaps as a new employee, business partner, or the like. While this compensation isn’t as straightforward as a simple number…

Improving Investor Behavior: Show Me Where it Hurts

Even with a rising paycheck, people feel inflation. Whether it's the cost of a can of soup or the price of gasoline, everything feels (and is) more expensive. Inflation puts a dent in household budgets and a psychological dent in attitudes. While the U.S. economy may be booming, the smaller economy of household budgets and expenses takes a hit.

Building Durability Into Your Plan and Portfolio

Never invest in anything that can kill you. Now I don't mean cigarettes or other harmful items, but instead making the mistake of investing so much of your capital into one venture that its failure could knock you out. That's the gist behind…

Improving Investor Behavior: A Mentality of Abundance, Not Excess

We've often said time is our most precious resource. More valuable than money, more fleeting than possessions, nothing can be done to stop the spending of our time. But like money and possessions, having too much time can be a bad thing.

I'm…

Improving Investor Behavior – Feeling Confident? Are You Sure?

I’ve contributed to the Denver Post monthly for a while now, and I’m grateful for readers who have reached out to me with thoughts, comments, and questions. Some about my writing, the market, and broader topics like the meaning of wealth…

How Do You Measure Your Wealth?

How do you measure your wealth? Most people assume there are two typical ways. The first is a simple money calculation that takes everything you own, subtracts everything you owe, and that formula gives you your net worth. Simple. Others say wealth is not a measure of the money one has but of the intangibles such as relationships, time, health, etc.

Improving Investor Behavior – Deciding on Enough!

At a party given by a billionaire on Shelter Island, the late Kurt Vonnegut informed his friend author Joseph Heller that their host, a hedge fund manager, had made more money in a single day than Heller had earned from his wildly popular…

Many Americans Face a Bitter-Sweet Early Retirement. What Should They Do?

He was sitting on a bus stop bench outside a tranquil park, wearing a khaki suit, checkered blue shirt and sneakers. A plain white box rested on his lap when he greeted a stranger and offered her a chocolate saying, “My Mama always…

Craft Beer & Why You Need a Financial Advisor

On sunny afternoons, my wife and I enjoy finding a patio at a local brewery to enjoy a cold beverage and play card games. Our favorite spot is Living The Dream Brewing in Highlands Ranch (Drink Local!). When there, I suggest trying one of their…

It’s baseball season! What inning is your financial life in?

“Every day is a new opportunity. You can build on yesterday’s success or put its failures behind and start over again. That’s the way life is, with a new game every day, and that’s the way baseball is.” – Bob Feller

Bob Feller,…

Why Am I Here?

Why am I here?

Well, there’s an existential question for reflection.

I pose this question not to discuss the meaning of our lives, but instead to share why I chose to join Prosperion Financial Advisors and build a practice as…