Tag Archive for: Denver Gazette

The Quiet Power of Dividends

They aren’t flashy. They don’t dominate headlines. They rarely fuel cocktail-party conversations or social-media bravado. In a market obsessed with price momentum, dividends can feel like the broccoli of investing — nutritious, dependable and routinely ignored in favor of something more exciting.

Looking Forward with the Perspective of the Past 50 Years

Most people reading this column — whether early in their careers or well into retirement — have had their entire financial lives shaped by the events between 1975 and 2025. And yet almost none of us were taught to study that period carefully. Instead, we’ve been conditioned by markets, media and our own wiring to obsess over what’s happening today and what might come next.

Such a short-term obsession is the enemy of good investor behavior.

Your Plan (and Behavior) Matter More Than the Headlines

The biggest success determinant has nothing to do with cleverness or timing. Instead, it has everything to do with having a plan and sticking to it.

Amid all the noise in today’s world, it’s easy to get distracted from the foundation of your financial plan. By returning to those core principles, you can recalibrate to your highest priorities, both for now and the future.

Overcoming Inflation Using a Familiar Friend (Part 2)

If your income doesn’t rise to match inflation, your lifestyle must fall to compensate. That’s not pessimism but basic math.

Understanding Inflation, the Silent Killer (Part 1)

Among the greatest long-term threats to retirees and investors is inflation. The world was reminded in recent years — and almost overnight — just how quickly inflation can roar back to life.

Human Nature Is a Failed Investor—But Your Plan Doesn’t Have to Be

When I entered this business in the late 1970s, I quickly realized that markets weren’t the real challenge — people were. Not because they lacked intelligence or information, but because the human mind is wired for survival, not investing.

Anchoring: The Mindset Mistake That Quietly Steers Investors Off Course

I meet monthly with thoughtful, experienced investors who genuinely seek the best decisions. Despite any savviness, however, they often fall prey to a similar mental trap: anchoring. It’s not one of ignorance but of human nature.

Anchoring…

The Underestimated Orchard

The one force in finance that remains stubbornly misunderstood is compounding. Human brains have evolved to understand straight lines, not curves. We grasp addition and subtraction, but our intuition breaks down around exponential growth. We…

The Trouble with Target-Date Funds

Target-date funds have quietly become the default investment choice for millions of Americans. In workplace retirement plans, they’re the path of least resistance — simple, convenient and automatic. Select the year you plan to retire, direct…

Current Events Only Raise Uncertainty

Every investor I’ve met has, at some point, asked a version of this question: “Given what’s going on right now, what should I do?”

As a financial advisor, I always consider this a reasonable thought. The world is unpredictable: Wars…

Sketchplanations

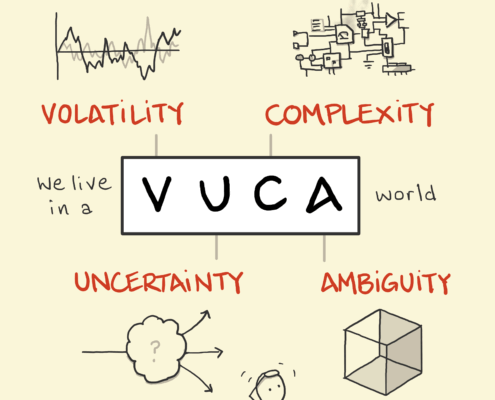

SketchplanationsThe Antidote to Ambiguity

Toward the end of the Cold War, a new kind of landscape emerged — defined by turbulence, ambiguity and interconnection. In that moment, folks at the U.S. Army War College coined the term VUCA, an acronym for Volatility, Uncertainty, Complexity and Ambiguity.

The Certainty of Uncertainty

Remember that as investors, we are constantly on the precipice of uncertainty. We can never confidently know how anything will play out. No one can. So what should we do? With everything changing, we think we should be adapting. New circumstances require portfolio changes, right?

A Quarter Century of Panic and Prosperity

As we enter fall 2025, the S&P 500 is in the green for the year. It’s as if April’s panic never happened. This isn’t a fever dream, but a reminder: Stick to your plan.