An Emotional Tour de Force

This last week has been a roller coaster for investors with large, swift swings in the broad market indices. It began with an announcement from the Federal Reserve on interest rates and the White House levying additional tariffs against China, which was then followed by a tit-for-tat spat between the two countries. A devaluation of the Yuan, the U.S. labeling China a currency manipulator, and a drop in the bond market yields all served as reasons for the corresponding drops.

All that to say, a lot has happened in the span of a few days. It’s given investors cause for concern, whether justified or not. But this is volatility. This is the price we investors pay to enjoy an historically above-average return from more stable investments like bonds (which are now devolving into negative yields in countries around the world).

We’ve seen this level of volatility before. Heck, we’ve seen it four times in the last year alone. Have a look at this chart which overlays the SP500 with the VIX (an index designed to calculate the expected measure of volatility in the market.)

This chart shows that the market’s level of fear, uncertainty and doubt (as proxied by the ratio of the Vix Index to the 10-yr Treasury yield) is today as high as it has been in many years.

What we see is a period of unrest following a new development like additional tariffs or a Fed announcement, then an often-swift recovery. Now, past performance doesn’t mean it will necessarily do the same thing in the future, but I’d say that’s a pretty well established pattern.

Also consider these facts:

- According to Bernstein Research, equity outflows vs. bond inflows from the previous six months are three times higher than the historic norms. That means more people have been pulling money out of stocks and into bonds, even more extreme than during the Great Recession of ’08-09.

- The 10-Year Treasury Bond is currently yielding about 1.75% compared to the S&P 500 has a dividend yield of 1.85%.

- Bonds never increase their coupon payment, but dividends often increase.

- Bank of America regularly surveys global money managers: 179 found equity allocations at their lowest levels in history. All the while bonds pay less than inflation (meaning you lose purchasing power on every dollar invested)

- We have experienced the longest economic expansion ever spurred on by changes in tax law, reductions in regulations, and pro-business policies, all the while with tepid inflation.

A simple idea, but one worth repeating: bull markets don’t die of old age. Just because we are now in the longest economic expansion in United States history does not mean we are “due” for a recession. Recessions typically have an underlying cause, which (to my recollection) has never been “because it’s been a while”.

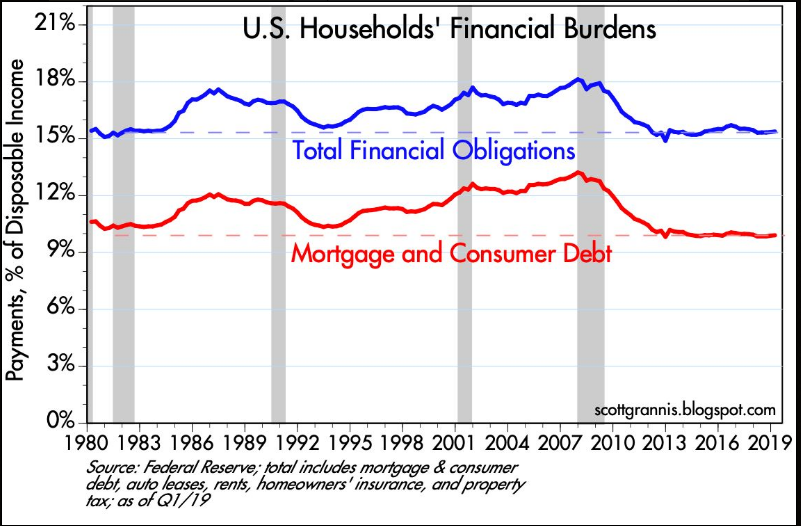

In fact, two things I like to keep an eye on: household debt payments as a percentage of income:

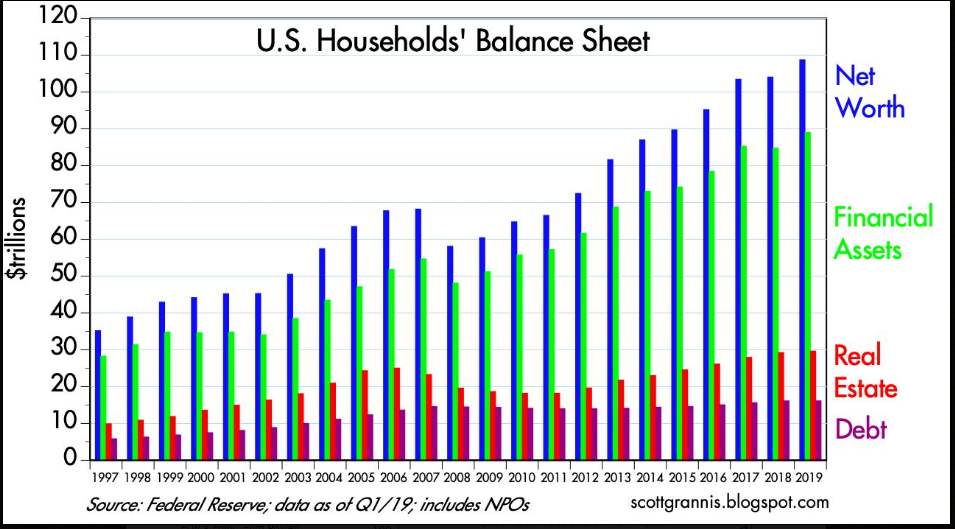

and household net worth (balance sheet), are both looking stronger than they have in years.

When your investment strategy is Growing Dividends and creating a long term reliable stream of income, you can focus on stocks that pay dividends and focus less on the market fluctuations that may occur. Dividends are real, historically growing at a rate greater than the inflation rate, protecting your purchasing power from the real risk of losing money: inflation.

In summary, ownership of great companies has been an extraordinary way for long-term investors to help build and protect their purchasing power throughout their lives, first while accumulating and later as retirees. Growing your income during a 30 – 40 year period of retirement is critical to protecting investors’ capital from the loss of purchasing power of inflation.

Times like these are often emotional reactions to the news of the day, with the swiftness of price changes due in part to the ease at which people can trade stocks from their desktop, phone, or even smart watch. We see these as opportunities to acquire our favorite companies at a discount, opting for logical long-term growth over an emotional short-term reaction.

If you have any questions or concerns or want to have a conversation about your portfolio, we encourage you to give us a call.

Steve Booren is the Owner and Founder of Prosperion Financial Advisors, located in Greenwood Village, Colo. He is the author of Blind Spots: The Mental Mistakes Investors Make and Intelligent Investing: Your Guide to a Growing Retirement Income and a regular columnist in The Denver Post. He was recently named a Barron’s Top Financial Advisor and recognized as a Forbes Top Wealth Advisor in Colorado.