3 Reasons Why Market Volatility Shouldn’t Get You Down

It’s easy to feel like your investments are on a rollercoaster ride on a daily, weekly, and monthly basis.

Looking at historical market data shows us that, while potentially unnerving, short-term market fluctuations are normal. This holds true in many years that ended with a positive overall return.

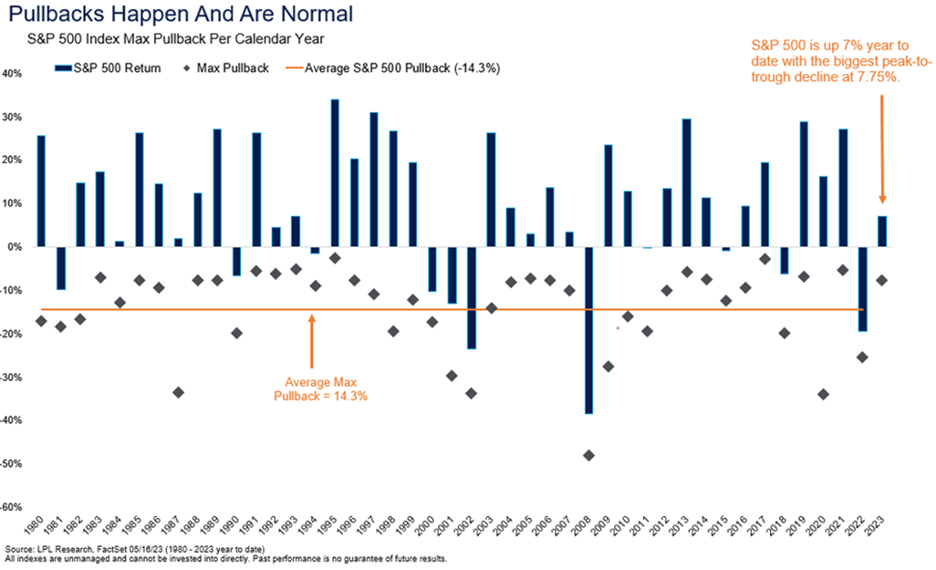

If you find that hard to believe, take a look at this chart from LPL Research.

What three insights should investors take from this chart?

- In an average year, since 1980, stocks have fallen 14% intra-year and ended the year 10% higher.

- Also, consider stocks experience an average of three 5-10% pullbacks and one 10% or larger correction each year.

- Close to 80% of the last 40 calendar years have finished with positive returns, even while experiencing a drawdown (sometimes significant) during the year.

There is no way to know which way the market will fluctuate in the short run.

We only know that the market will fluctuate.

But these fluctuations are to be expected, not to be feared.

When investors ignore the noise and patiently focus on the long run, they might find it a little easier to enjoy the ride.

Hello! I am Danny Kellogg, an LPL Financial Advisor with Prosperion Financial Advisors. The best part about my job is using my experience and education to help clients discover how their financial resources can serve them. To deepen my knowledge and demonstrate my dedication to serving clients at the highest level, I became a CERTIFIED FINANCIAL PLANNER® and Retirement Income Certified Professional®. My wife Elizabeth and I are both proud Colorado natives. We live in Centennial, CO with our daughter Libby and golden retriever Aggie. I am an avid Colorado sports fan who enjoys cheering on the Rockies, Broncos, Avalanche, Nuggets and Colorado State University Rams. When I am not helping clients, I enjoy spending time with my family and playing golf.

All performance referenced is historical and is no guarantee of future results.