The Gray Area of Good Investor Behavior

If you’re a frequent reader of this column, you know that I’m a large proponent of good investor behavior. Though I’ve spent a great number of column inches espousing the traits of investors I admire or those who have done well by adopting a particular investment style or strategy, I’m constantly reminded that figuring out “good” investor behavior is far more complicated than it would seem.

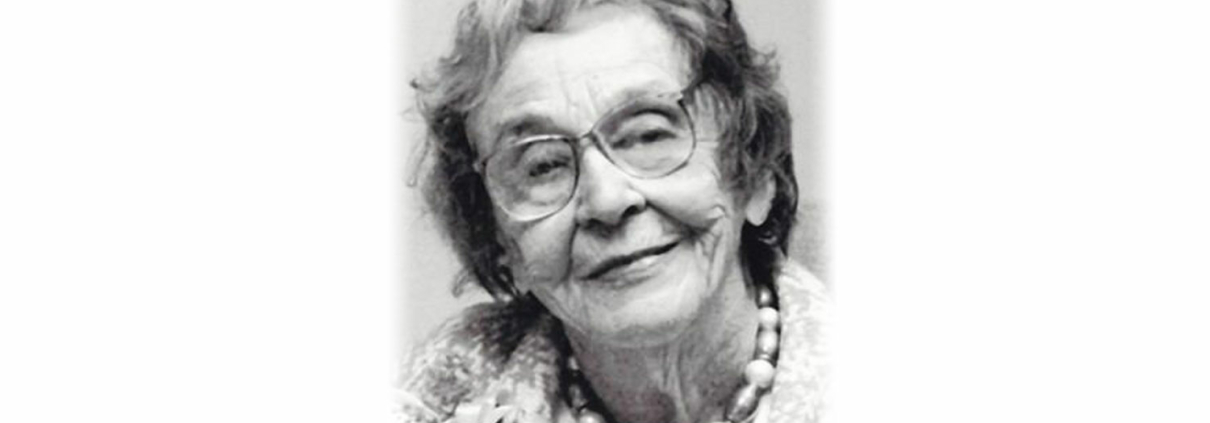

Take, for example, Anne Scheiber. For those unfamiliar with her story, Scheiber was an unknown and reclusive investor who passed away in 1995 at 101 years old. Her story has normal roots: she was an auditor for the IRS until her retirement in 1944. She never made more than $4,000 per year, failing to receive a promotion despite her excellent work ethic. Upon her retirement, she had saved $5,000 and received a $3,100 annual pension (about $80,601 and $49,973 in today’s dollars according to USinflationcalculator.com, respectively).

Yet Scheiber was able to accumulate about $22 million dollars during her life, almost all of which was donated to various women’s organizations and scholarship funds upon her death. To what was she able to accredit her success? For one thing, she followed dividend investment and reinvestment. She was also known to be incredibly frugal, even pilfering food from a meeting of shareholders and eating it over the next few days. She allegedly lived in the same apartment and wore many of the same clothes at the end of her life as she had in 1944.

Scheiber, by all accounts, was a “successful” investor. Her investments saw her through her life and contributed to a great many charitable causes. She accomplished what many of us try to with our portfolios. She had “good” investor behavior. And yet, an article in People Magazine described her as someone, “…few can recall smiling. Instead, they remember her as a friendless, pathologically frugal woman who seemed bitter as baker’s chocolate.”[1] Not exactly the description I want to be carved on my tombstone.

Her story is a stark reminder that “good” investor behavior is a function of your values. Her tax attorney, Benjamin Clark, said, “She got a lot of satisfaction knowing she was leaving this money. She’d say, ‘Someday when I’m long dead, there will be some women who won’t have to fend for themselves.’” Her values were clear, and she remained steadfast to them her entire life. So, while her values defined good behavior as extreme frugality and a very modest lifestyle, that may not always be the best fit for others. Instead, good behavior may be more about finding an appropriate balance. Saving is essential, but if it takes food off the table today, is it serving you?

A similar argument can be made when we encourage clients to pay off their homes. Yes, with mortgage rates at near all-time lows, this doesn’t make a whole lot of financial sense when looking at it on a spreadsheet. But we don’t live our lives on spreadsheets, and what looks good on the balance sheet may not feel as good as knowing your home is paid for with freedom from large monthly mortgage payments. There’s a feeling of security that comes with that financially “poor” decision; sometimes, that feeling is worth more.

Let’s look at two other opposed emotions: humility and arrogance. It’s easy to see the benefits of humility in investing. We often encourage clients to be students of the markets, to be willing to learn and grow, to have patience, and embrace new ideas. We foster a sense of optimism, as we feel that’s a fundamental disposition to successful investing. Arrogance is often blamed for many of the problematic behaviors associated with investing. Expecting to make a quick buck, knowing more than others, a sense of self-righteousness, and fostering a culture of fear and negativity.

But try to consider the opposite for a moment. Can arrogance sometimes be useful for investor behavior? If you subscribe to the efficient market hypothesis, then you would say that with all available information, every company in the stock market is priced exactly where it should be. If that doesn’t sound right to you, aren’t you essentially saying that you know something others don’t? Or, at the very least, believe that others are wrong about something on which you think you’re right? Isn’t that arrogance by definition?

As a result, we need to rethink our definition of arrogance. There’s a fine line between thinking an investment is a good idea and knowing an investment is a good idea. Usually, that line is discovered with practice, experience, and expertise. And so good behavior starts with figuring out where that line exists for you personally or finding someone who can help you understand when confidence is warranted and when overconfidence is clouding sound decision-making. Humility is understanding that even with all the information in the world, there is no predicting the future.

As Harvard professor Laurel Ulrich said, “Well behaved women rarely make history.” Good behavior is not a simple dichotomy of black and white. Instead, good behavior starts with an understanding of your values and what you determine to be “good.” With a sense of your values, start taking the actions necessary to pursue your goals. This is why planning is such an important element. Knowing where you want to go is essential to figuring out the best way to get there.

Much of what I’ve written about good investor behavior are traits I’ve seen time and again among those who were able to pursue the goals they set for themselves. For many of us, our goals will generally be similar when it comes to investing such as having the freedom to retire with income to support the lifestyles we want for the rest of our lives. But occasionally, goals will differ, as was the case with Anne Scheiber. Understand that “good” behavior is a function of your values and your goals, and always work to better understand what those are for you personally. That’s the foundation for even better investment behavior.

[1] https://people.com/archive/angel-in-disguise-vol-44-no-25/

Steve Booren is the Owner and Founder of Prosperion Financial Advisors, located in Greenwood Village, Colo. He is the author of Blind Spots: The Mental Mistakes Investors Make and Intelligent Investing: Your Guide to a Growing Retirement Income and a regular columnist in The Denver Post. He was recently named a Barron’s Top Financial Advisor and recognized as a Forbes Top Wealth Advisor in Colorado.